Insurance Score: Ranges, Correlation to Credit, and How to Improve It

Insurance companies increasingly use insurance scores – numerical ratings based on your credit history – to help set auto, homeowners, and even some commercial insurance premiums. In this article, we’ll explain what an insurance score is, the typical point ranges (minimum, maximum, and average), how it correlates with your FICO credit score, and which insurers use it. We’ll also discuss whether you could have an 800 FICO credit score but a low insurance score, practical ways to improve your insurance score, and the legal landscape (including state bans on credit scoring and data providers like LexisNexis). Throughout, we’ll highlight how Cogo Insurance can help clients with any insurance or credit score find the right coverage and rates.

What Is an Insurance Score?

An insurance score (or credit-based insurance score) is a three-digit number derived from your credit report data, used by insurers to predict the likelihood that you’ll file insurance claims. It is not the same as a standard credit score used by lenders, but it relies on similar credit information – such as payment history, outstanding debts, length of credit history, new credit inquiries, and types of credit – weighted differently for insurance purposes. The key idea is that statistically, people who manage credit responsibly tend to file fewer or less costly insurance claims. Insurers view a higher insurance score as indicating lower risk, which can translate to lower premiums, whereas a low insurance score suggests higher risk and potentially higher rates.

It may not seem intuitive that credit habits relate to driving or homeownership risk. However, multiple studies (and industry experience) have shown a strong correlation. For example, the U.S. Federal Trade Commission’s analysis found that credit-based insurance scores are predictive of the number of claims consumers file and the total cost of those claims. A University of Texas study similarly found that drivers with the worst insurance scores had roughly double the average claim losses of those with the best scores. In practice, insurance scores give underwriters an objective, data-driven tool to help price policies in line with risk.

Cogo Insurance can help demystify insurance scores for you – our agents explain how your score might be affecting your rates and ensure you still get competitive quotes no matter your credit score.

Insurance Score Range and Average Points

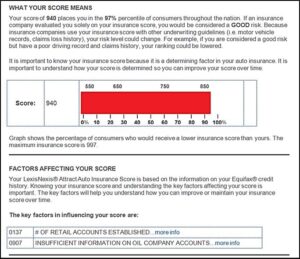

Insurance scores typically span a wide range of values. The exact range depends on the model, but one commonly used credit-based insurance score is LexisNexis® Attract. The LexisNexis Attract insurance score ranges roughly from 200 up to 997 points. According to LexisNexis, scores in the high 700s and above are considered good, while mid-600s to mid-700s are average. Specifically, a LexisNexis insurance score can be categorized as follows:

-

Good: 776 to 997 (the highest tier)

-

Average: 626 to 775 (mid-range)

-

Below Average: 501 to 625 (subpar credit-related history)

-

Less Desirable: 500 or below (very poor credit history)

Most consumers fall somewhere in the middle of this range. An “average” insurance score is around the mid-600s to low 700s. Each insurer sets its own cutoff for what it considers a good score. For example, one company might offer its best rates to anyone with an insurance score above 700, whereas another might require 750+ for the top discount tier. There is no single universal “average” or “good” score across all insurers, but the LexisNexis categories above provide a general benchmark. TransUnion (one of the major credit bureaus that also generates insurance risk scores) notes that a “good” insurance score is usually around 770 or higher.

It’s important to note that insurance score scales are different from FICO credit score scales. A typical FICO credit score ranges from 300 to 850, whereas insurance scores often use a broader or shifted range (e.g. 200–997 for LexisNexis, or another scale for FICO’s own insurance score model). Therefore, an insurance score of 700 is not “700 out of 850” but rather 700 on its own scale. In practice, however, if you have a strong FICO credit score, you likely have a strong insurance score as well, since both are driven by similar positive factors (no late payments, low debts, long credit history, etc.) Industry experts note that a good credit score is a strong indicator of a good insurance score – if your FICO score is “decent,” your insurance score is likely (though not always) on par.

Correlation to Your FICO Credit Score

While insurance scores and credit scores are distinct, they are highly correlated. Both use your underlying credit report data, but they predict different outcomes: a credit score predicts likelihood of 90-day late payments on loans, whereas an insurance score predicts the likelihood of an insurance loss/claim (experian.com). Because of this different goal, insurance scoring models may weigh certain aspects of your credit differently than FICO does. For instance, FICO’s regular credit score emphasizes payment history (~35%) and amounts owed (~30%), among other factors. FICO’s Insurance Score (an insurance-specific model) similarly weighs payment history heaviest (40%), followed by outstanding debt (30%), length of credit history (15%), pursuit of new credit (10%), and credit mix (5%) (self.inc). These weightings are comparable to a regular FICO score model, but insurance models might de-emphasize or ignore factors not relevant to insurance risk. For example, your income, address, job, gender, ethnicity, and other personal demographics are NOT included in your insurance score – only your credit behavior is considered.

In general, higher FICO = higher insurance score, and vice versa, but there are cases where they diverge. Each scoring model is proprietary, so details are limited, but you could imagine a scenario: Perhaps you have an 800 FICO score thanks to impeccable payment history and low credit utilization, yet your insurance score might come out lower if, say, you have a very short credit history or only one credit account. An insurance model might view a limited credit history as a risk factor (lacking depth of experience), even if your one account is perfect. Likewise, if you have opened several new credit accounts recently, your FICO score might still be high (especially if those inquiries are a few months old and you handle new credit well), but an insurance score formula could penalize the “seeking new credit” more heavily, making your insurance score lag behind. Such situations are not common, but they can happen – the scoring systems are similar but not identical. As NerdWallet explains, your credit score is a good bellwether for your insurance score, but it “is likely (but not always) on par” – exceptional credit usually means a strong insurance score, though there are exceptions.

The bottom line is that if you focus on maintaining a high traditional credit score, you’ll usually benefit from a high insurance score as well. And if you find that your insurance score is inexplicably low despite a great credit score, it’s worth reviewing the factors and possibly consulting with your insurance agent (or obtaining your specialty credit reports, as discussed later). Cogo Insurance’s team can help review your situation – if your premiums seem high for your known credit level, we can assist in investigating and finding insurers that might be more forgiving or better suited to your profile.

Why Insurers Use Credit-Based Insurance Scores

Insurers use insurance scores because they have been statistically proven to enhance risk prediction for underwriting in personal lines (it is much more debatable in commercial lines). In other words, credit-based scores give insurers a consistent, objective measure that correlates with the likelihood of future claims. Multiple studies by regulators and academics have validated this link. As noted above, the FTC’s 2007 report found that insurance scores are predictive of claim frequency and cost (myfico.com). The University of Texas study in 2003 found that drivers with the worst credit-based insurance scores had twice the claims of those with the best scores (nerdwallet.com). Insurers also cite their own data showing a “clear correlation between insurance scores and risk of loss” (insurancejournal.com) – essentially, on average, customers with low scores tend to incur more losses, whereas those with high scores incur fewer.

From an insurance company’s perspective, using credit information adds a layer of objectivity and accuracy in pricing. It helps them segment customers more finely by risk. This doesn’t mean credit is the only factor – far from it. Insurers still consider many other variables when setting rates, such as your driving record, claims history, vehicle type, age, location, etc. The insurance score is just one piece of the puzzle, albeit a significant one. In fact, in nearly all states, insurance regulators do not allow credit score to be the sole reason for an adverse action on a policy (like denial, cancellation, or premium increase). Credit can contribute to a pricing decision, but it must be used in combination with other factors. For example, if you have a perfect driving record and no prior claims, a poor insurance score alone usually cannot double your rate – but it might prevent you from getting the very best discount tier. Conversely, if you have a few dings on your driving record, a great insurance score could help offset those and keep your premium lower.

Notably, the industry often argues that credit-based scoring benefits more customers than it hurts. According to industry surveys, about 75% of insurers report that the use of credit information actually lowers premiums for the majority of their policyholders (those with good credit) (self.inc). In other words, insurers say they give discounts to customers with high insurance scores, rather than surcharges to those with low scores in most cases. One insurance executive cited an example that a company might even overlook a minor driving infraction if the person’s insurance score is top-tier – for instance, some insurers will ignore certain motor vehicle report (MVR) issues like speeding tickets if you fall into their highest credit tier. This indicates how powerful the insurance score can be: a stellar score can sometimes outweigh other negatives, because the insurer trusts that client as a lower-risk overall.

Cogo Insurance understands how each insurer in our network uses insurance scores. We can identify which companies rely on it heavily and which are more lenient. This means we help our clients find insurers that best fit their individual profiles, whether they have excellent, average, or poor credit. Our goal is to ensure that even if your insurance score isn’t ideal, you still get fair pricing by possibly placing you with carriers that weight other factors more.

Which Insurers Use Insurance Scores?

In today’s market, nearly all major insurance companies use credit-based insurance scores in states where it is permitted. According to FICO (the company behind the FICO credit score and a creator of insurance scoring models), about 95% of auto insurers and 85% of homeowners insurers factor in credit-based insurance scores when pricing policies (self.inc). More recent data reinforces that figure: roughly 95% of auto insurance carriers use insurance scores as of 2023 (nerdwallet.com). This includes most household-name insurers. For example, State Farm, GEICO, Progressive, Allstate, Farmers, Liberty Mutual, Nationwide, American Family, Travelers, and USAA all incorporate credit-based insurance scores into their underwriting and rating formulas in states that allow it. These companies represent the bulk of the personal insurance market, and they do use credit data as one rating factor among others. Smaller regional insurers and many specialty insurers use it as well, given how widespread the practice has become.

To illustrate, a NerdWallet analysis of major insurers’ rates found that virtually all of the top 10 largest auto insurers charge higher premiums to drivers with poor credit versus those with good credit (all else being equal). The difference can be substantial – for instance, one major insurer’s average rate for a driver with good credit was around $1,431/year, but for the same driver with poor credit it was $3,484/year (over $2,000 higher). Another big-name carrier had an average premium of $2,009 for good credit drivers versus $2,938 for poor credit (a ~$929 increase). These examples show that most insurers indeed adjust pricing for credit, and the impact can range from moderate to quite significant. Cogo Insurance works with many of these insurers, and we keep track of their underwriting guidelines – if your insurance score is dragging your rate up with one company, we can help you shop around for a better option.

It’s worth noting a couple of exceptions: A few newer insurance companies have positioned themselves against credit scoring. For example, Root Insurance (a usage-based insurer) announced it will eliminate credit scores from its pricing model by 2025. In Texas, a startup insurer called Dillo offers auto policies with “no credit check” quotes. These are still relatively niche players, but they reflect a consumer pushback against credit-based pricing. By and large, though, if you’re shopping for auto or homeowners insurance, you should assume your credit history will be considered by about 19 out of 20 insurers. That’s why improving your insurance score can pay off across the board. And remember, Cogo Insurance can help find you the best deal among the carriers – even if one company penalizes your score more heavily, another company might be more forgiving, and we’ll guide you to the right match.

States That Prohibit or Limit Insurance Credit Scores

Insurance scoring is not legal in every state. A few states ban the use of credit history for insurance entirely, and others impose restrictions on how it can be used. As of now, California, Hawaii, and Massachusetts have the most stringent rules – they prohibit insurers from using credit-based insurance scores to set rates or determine eligibility for auto insurance (and in California and MA, for homeowners insurance as well). In these states, insurance companies must rely on other factors (driving record, location, claims history, etc.) without any consideration of your credit info. For example, a California insurer cannot raise or lower your car insurance premium based on your credit score – it’s simply off the table by law.

Several other states have partial bans or limitations. Maryland forbids using credit to refuse or cancel a policy and doesn’t allow credit factors for renewing homeowners insurance; it only allows credit scoring to potentially offer a discount on new auto policies (not to surcharge). Michigan had an interesting history: regulators there tried to ban credit scoring, but in 2010 the Michigan Supreme Court ruled that insurers could use credit scores (with some limits) – currently Michigan insurers can’t use credit to determine rates or eligibility, but they may use it for setting up payment installment plans or discounts. Nevada imposed a temporary ban on credit-based insurance score usage during the COVID-19 pandemic (preventing credit use for rate changes from March 2020 until May 20, 2024). Oregon allows credit scoring for new policies but restricts it for renewals or cancellations. Utah allows insurers to use credit for offering lower rates or for new policy underwriting, but not to non-renew or hike rates on existing customers due to credit.

The patchwork of state laws can be complex. Here is a summary of key state rules on insurance scores in personal lines:

| State | Credit Scoring Use |

|---|---|

| California | Banned – Cannot use credit for auto or home insurance. |

| Hawaii | Banned for auto – Auto insurers can’t use credit. (Allowed for home insurance). |

| Massachusetts | Banned – Cannot use credit for auto or home insurance. |

| Maryland | Restricted – For auto insurance, credit can only affect rates on new policies (no denials); banned for home insurance rates. |

| Michigan | Restricted – Can’t use credit to set rates or deny coverage; only allowed for payment plans or discounts (no impact on base rate). |

| Washington | (Attempted ban) – Regulators attempted to ban credit use in 2021; after legal challenges, credit scoring is currently allowed (no permanent ban as of 2025). |

| Oregon | Partial – Credit score may be used for new policies’ rates, but not for renewals or cancellations. |

| Utah | Partial – May use credit info to lower rates or decide new policy eligibility; cannot use to increase existing rates. |

| Nevada | Temporary ban – Suspended credit use through May 2024 for pandemic relief. (After expiration, credit use resumed per prior rules.) |

Note: All states that allow credit scoring still require that it not be the sole factor in an insurance decision. Insurers must notify you with an adverse action notice if your credit-based score leads to a higher rate or denial, listing the top reasons (e.g. “too many late payments” or “high outstanding debt”) that negatively impacted your score. This notice is your window into knowing that your credit hurt your insurance price.

If you live in a state where insurance scores are banned (like CA, HI, MA), you won’t need to worry about credit when shopping for insurance – and Cogo Insurance can help you find the best rates using other factors. In states with partial restrictions, it gets complicated; our agents stay up-to-date on these regulations. For instance, if you’re in Maryland or Oregon, we know which companies’ pricing might hinge on your “neutral” credit score or how to navigate a new policy vs. renewal scenario. Our goal is to make sure state laws work in your favor as much as possible, and we always follow the regulations when helping you shop for insurance.

Who Provides Insurance Scores and How to Get Yours

Insurance scores are provided by specialized analytics companies and credit bureaus. The two most prominent creators of insurance scoring models are FICO (Fair Isaac Corporation) and LexisNexis Risk Solutions, both of which introduced credit-based insurance scoring tools used by insurers. TransUnion, one of the three major credit bureaus, also offers its own insurance risk score model (sometimes referred to as TrueRisk) used by some insurers. In fact, FICO, LexisNexis, and TransUnion all develop credit-based insurance scores that insurers can purchase or license. Many insurance companies use these off-the-shelf models, while some larger insurers have even developed proprietary scoring algorithms tailored to their customer base. However, even proprietary models are usually built from credit bureau data and resemble the general approach of the well-known scores.

-

LexisNexis® Attract Score: A widely used credit-based insurance score. LexisNexis is a consumer reporting agency that aggregates data from the three credit bureaus to produce the Attract score (range 200-997, as described earlier). Insurers often obtain an applicant’s Attract score through LexisNexis when quoting a policy. LexisNexis stopped selling the score to consumers around 2019, so it’s hard to know what is your score. LexisNexis also manages the Comprehensive Loss Underwriting Exchange (C.L.U.E.) reports for prior claims, but those are separate from the credit score.

-

FICO® Insurance Score: FICO introduced insurance scores in the 1990s and provides models that use credit report data to predict insurance risk. FICO’s insurance score doesn’t have a publicly disclosed range, and it might vary by bureau (similar to how FICO credit scores have variants). FICO has revealed the general factor weights (e.g. 40% payment history, 30% debt, etc. as noted above) but not the exact scoring scale. Many top insurers use FICO’s version behind the scenes, or a blend of FICO and LexisNexis data.

-

Credit Bureaus (TransUnion, Experian, Equifax): The bureaus supply the raw credit reports that these scores are based on, and some offer their own scoring services. TransUnion’s insurance score, for example, ranges approximately 150 to 950 (different scale) and it brands its model as reflecting insurance risk. Experian and Equifax may not have standalone insurance scores sold widely (often they partner with LexisNexis or FICO), but they do support the data and provide educational content about credit-based insurance scores.

Given that insurance scores are mostly based on your credit file, checking your insurance score is not as straightforward as checking your regular credit score. You typically won’t find your “insurance score” on a consumer credit report or a free credit monitoring app. Insurers generally do not proactively tell you your score unless it adversely affected you (in which case you get the adverse action notice with reasons, but often not the exact number). However, you do have the right to access the information that specialty consumer reporting agencies have on you.

One way to get insight (without the score) is to request your LexisNexis Consumer Disclosure report. Under the Fair Credit Reporting Act (FCRA) and the FACT Act, you are entitled to one free copy every 12 months of your consumer file from nationwide specialty bureaus like LexisNexis (consumer.risk.lexisnexis.com). LexisNexis’s disclosure will include your insurance-related info – this will show factors influencing your CBIS, as well as your C.L.U.E. claims history. You can request this online or via mail/phone; LexisNexis provides a portal for consumers to get their report for free. Similarly, if an insurer used a TransUnion insurance score, you could contact TransUnion for any insurance score information in your file (often, if you provide the adverse action notice details, they can generate a report).

Keep in mind that an “insurance score” will not appear as a simple number on these disclosures – you might instead see the range it falls into or the adverse reason codes. But the data is there for you to review and dispute if needed. If you were denied insurance or charged a higher rate due to credit, the adverse action notice should also include instructions on obtaining a free copy of the credit report or specialty report that was used. This is a good opportunity to check if there were any errors in your credit data that hurt your score.

The other factor in the CBIS is your driving history, which insurers get from car manufacturers or their data brokers. To check what information your vehicles are sharing, type the VIN number into this website of Privacy4Cars.

Cogo Insurance advises clients to take advantage of these free reports: knowing what’s in your LexisNexis file can be empowering. For example, if you find an error in your credit report (such as a falsely reported late payment), correcting it can improve both your regular FICO score and your insurance score over time.

In summary, the companies furnishing data to produce insurance scores include the credit bureaus and analytics firms like LexisNexis and FICO. You have the right to see and correct the information they have on you. Our team at Cogo Insurance can guide you on how to request your LexisNexis or credit bureau reports if you suspect your credit is impacting your insurance quotes.

Can You Have a High Credit Score (e.g., 800 FICO) but a Low Insurance Score?

This is a common question: Could someone with excellent credit – say an 800 FICO score – still end up with a poor insurance score? The short answer is yes, it’s possible, but it’s uncommon. Because insurance scores and FICO scores draw on the same underlying data, they generally move in parallel. If you’ve hit 800 on FICO (which is a superb credit score), most factors on your credit report are very favorable – you pay on time, have low credit utilization, a long and positive credit history, etc. These factors likewise would boost an insurance score. As mentioned, your credit score is usually a strong indicator of your insurance score. In practice, someone with an 800 FICO will likely be in the top tier of insurance scores as well (perhaps “Good” 776+ on LexisNexis, or equivalent).

However, there are niche scenarios where the scores might diverge. Each scoring model emphasizes factors differently. For example, FICO’s 800 might tolerate that you only have a couple of active accounts (perhaps one credit card and one mortgage) because you’ve managed them perfectly over, say, 10+ years. Now imagine an insurance score model that prefers to see a bit more variety or more recent active credit usage – it might ding you slightly for having a thin but old file. Or consider inquiries: maybe you did refinance your mortgage and opened a new credit card recently. Your FICO score of 800 suggests those inquiries and new accounts didn’t hurt much (since you remained in the excellent range). But an insurance score algorithm might count the number of recent inquiries as a bigger negative flag (insurers worry that multiple new accounts could indicate financial stress or greater risk-taking). Thus, your insurance score might come out lower than expected, perhaps only “average” despite an excellent FICO.

Another factor could be that insurance scores sometimes exclude certain information that credit scores include, or vice versa. For instance, FICO scores do not consider small collection accounts under $100, whereas an insurance model might still consider the presence of any collection as a negative. Conversely, insurance scores ignore things like your income or job (which aren’t in your credit report anyway), but they might also ignore your credit mix (types of credit) or give it minimal weight. If your 800 FICO was partly bolstered by having a good mix of installment loans and revolving credit, an insurance score might not reward that aspect as much, instead focusing on just payment history and debt levels. So theoretically, yes – an individual could have great credit in the eyes of lenders, but some quirks in their profile cause an insurance score formula to rank them a bit lower.

It’s worth noting, though, that such discrepancies are usually not extreme. If you truly have an 800 FICO, your insurance score is highly unlikely to be “low” (like in the under-600 poor range). At worst, it might be somewhat lower tier relative to other top scorers – maybe you land in the “average” 626–775 bracket for insurance score instead of “good,” due to one factor. The key takeaway is that good credit almost always means a good insurance score, but on rare occasions a specific credit profile could score differently between models. If you suspect this has happened to you, you should inquire which insurance score was used and what factors were listed as negative. You can then work on those factors (for example, if the only issue was “short credit history,” time will naturally improve that; or if “recent inquiries” were flagged, avoid new credit for a while).

Cogo Insurance can help clients in this situation by doing two things: (1) shop your insurance with multiple carriers – if one company’s scoring model didn’t favor you, another’s might give a better result – and (2) provide guidance on which credit factors to address. We’ve seen cases where a client’s traditional credit was excellent, yet they got suboptimal insurance quotes due to a nuance in their credit report. Our agents stepped in to find an insurer that was more suitable, and advised on steps to align both scores. The good news is that if your finances are solid enough to have a high FICO score, you’re already in great shape; any insurance-score issues should be solvable with minor tweaks.

How to Improve Your Insurance Score (Practical Steps)

Because your insurance score is derived from your credit report, improving it really comes down to improving your credit. There’s no separate magic formula for an insurance score – it rewards the same responsible financial behaviors that lead to a good credit score. Here are practical ways to boost your insurance score:

-

Check Your Credit Reports and Scores: Start by reviewing your current credit standing. You’re entitled to a free credit report from each bureau (Equifax, Experian, TransUnion) annually via AnnualCreditReport.com. Scan them for any inaccuracies or negative items. Also check your credit score (many banks or free services offer FICO score updates). Knowing where you stand is crucial. If you spot errors on your report (for example, a payment wrongly marked late or an account that isn’t yours), dispute them with the credit bureau. Cleaning up errors can immediately lift your score. Additionally, consider requesting your LexisNexis consumer report as mentioned earlier, to see if any public records or old issues are dragging down your insurance score. Correcting an error or outdated item there can help as well.

-

Pay All Bills on Time, Every Time: Payment history is the #1 factor in both credit and insurance scores. A single late payment or delinquent account can severely hurt your score. Commit to never missing a due date. Set up automatic payments or reminders if needed. If you have any past due accounts now, work with creditors to bring them current as soon as possible. Over time, consistent on-time payments will rebuild a positive history. (Late payments generally impact your score less as they age, especially if no new ones occur.) Maintaining a spotless payment record will steadily improve your insurance score.

-

Reduce Your Credit Card Balances (Lower Utilization): High revolving debt can signal financial stress. Try to pay down existing credit card balances to below 30% of your credit limits (and the lower, the better). For example, if you have a $5,000 credit limit, keep the balance under $1,500. This improves your credit utilization ratio, which in turn boosts your credit scores and thus your insurance score. If possible, pay cards in full each month. Reducing outstanding debt has a significant positive impact on scoring. Also avoid maxing out any single account. If you received an adverse action reason like “Proportion of balances to credit limits is too high,” this is the remedy.

-

Avoid Too Many New Credit Applications: Each time you apply for a loan or credit card, a hard inquiry appears on your report and can shave a few points off your score. Multiple inquiries or new accounts opened in a short time can be a red flag for both lenders and insurers. To improve your insurance score, refrain from unnecessary credit applications, especially if you’re about to shop for insurance. If you know you’ll need a new car loan or credit card, try to space them out and only apply when truly needed. Let your accounts age and demonstrate stability. This way, you won’t be penalized for “seeking credit” too often.

-

Build a Long, Positive Credit History: Time is an ally in credit scoring. The longer you have accounts open in good standing, the more it boosts your score. You can’t create age overnight, but you can avoid closing your oldest accounts (keep that long-tenured credit card open, even if you only use it sparingly). Also, if you have a “thin” file, consider cautiously diversifying your credit mix with a type of credit you lack – for example, a small credit-builder loan or a secured credit card – to show more history, but do this sparingly and only if needed. Generally, focus on keeping existing accounts healthy and alive. Over time, as your average account age grows and any past negatives fade, your insurance score will improve. Be patient; credit rebuilding is a marathon, not a sprint.

-

Keep Tabs on Your Progress: Improving your insurance score won’t yield instant results, so monitor your credit every few months. Use free tools or credit score services to see if your efforts are reflecting in a higher score. Remember, you won’t typically see your insurance score directly, but rising FICO/Vantage scores are a good proxy. If you have a significant negative mark (like a collection or bankruptcy), know that it can take time (7-10 years) to fully fall off, but its impact will lessen each year that passes without new issues.

By following these steps, you’ll not only bolster your insurance score but also your overall financial health. Cogo Insurance is here to help along the way – our agents can offer tips specific to insurance considerations. For instance, if you’re improving your credit, let us re-shop your policy at renewal; a better insurance score could qualify you for a lower rate, and we’ll make sure you benefit from it. Even during the improvement process, we can often find carriers that are more competitive for lower scores so you don’t overpay in the interim. Whether your score is 500 or 800, Cogo Insurance can assist you in securing the coverage you need at the best possible price.

Controversies and Lawsuits Around Insurance Scores

The use of credit-based insurance scores has not been without controversy. Consumer advocates have long raised concerns that tying insurance rates to credit history can be unfair or discriminatory, even if unintentional. Critics argue that factors affecting credit (such as job loss, medical debt, or lack of credit history) don’t have anything to do with driving safely or maintaining a home, yet they result in higher insurance costs for those already struggling. There’s also concern about disparate impact – since credit scores on average can vary by income level and race (due to broader economic inequalities), using them in insurance might disproportionately burden lower-income individuals and communities of color. In the words of Consumer Reports, “It is fundamentally unfair to penalize consumers with higher insurance rates just because they have a less than stellar credit score… Your credit score has nothing to do with whether you are a responsible driver or homeowner” (insurancejournal.com). Advocacy groups like Consumer Federation of America, NAACP, and others have at times called for bans on insurance credit scoring, citing its potential to exacerbate societal inequities.

This tension has led to regulatory battles and lawsuits. On the regulatory side, we saw earlier that states like California and Hawaii outright banned credit in underwriting. In 2021, Washington State’s insurance commissioner attempted to impose an emergency ban on credit scoring, arguing the pandemic’s economic impact made credit use unfair. However, that move was challenged in court by insurer trade groups; insurers sued to stop the ban, claiming the commissioner overstepped his authority. The American Property Casualty Insurance Association (APCIA) argued that credit scoring is an “important risk-based tool” in use for nearly 20 years and that eliminating it would raise rates for over a million Washington consumers (because insurers could no longer give discounts to those with good credit). In that case, a judge ruled the commissioner’s ban exceeded his authority, and Washington’s ban was halted. This highlights how contentious the issue is – regulators push for consumer protection, while insurers litigate to keep using a tool they believe is actuarially justified.

On the legal front, there have been class-action lawsuits alleging that insurance credit scoring is discriminatory. One notable case was Ojo v. Farmers Group, Inc., a class action in Texas. The plaintiffs (led by Patrick Ojo) claimed that Farmers’ credit scoring system had a disparate impact on minority policyholders – essentially that it resulted in higher premiums for African-American and other minority groups, violating civil rights laws. The case went through several courts and eventually a question was certified to the Texas Supreme Court. In 2011, the Texas Supreme Court held that Texas law permits insurers to use race-neutral credit factors even if they lead to a disparate impact on different racial groups (law.justia.com). The court noted that Texas statutes expressly allowed credit scoring for insurance, as long as it wasn’t intentional race-based discrimination, so the practice was legal even if outcomes differed statistically by race. This was a win for the insurance industry; it essentially meant that such disparate impact claims would not succeed under existing Texas law, absent evidence of intentional bias.

Elsewhere, State Farm (the largest auto insurer) faced a class-action lawsuit alleging various discriminatory practices – in one 2015 settlement, State Farm paid $250 million to settle claims that it had charged higher premiums and even engaged in “redlining” (denying coverage in certain minority neighborhoods) which disproportionately affected African-American and Hispanic customers. While that case wasn’t solely about credit scores, it underscores the scrutiny on insurance rating factors and algorithms for potential bias. More recently, some insurers have been accused of using data and algorithms (which could include credit data) in ways that result in “proxy discrimination” – a practice now on regulators’ radar under the topic of AI and big data fairness.

In response to these concerns, insurance companies maintain that insurance scores are only one factor and that they never consider protected attributes like race or income. They cite studies (and court findings like in Michigan) that insurance scoring is actually fairer, because it’s objective and helps more people get discounts. For instance, the Michigan Supreme Court, when overturning the credit ban, commented that prohibiting insurance scores could make insurance less affordable for many, since “the most powerful predictor of losses” would be gone and insurers might raise base rates for everyone. Insurers also argue that without credit, they’d have to rely relatively more on factors like location or claims history, which come with their own equity concerns.

This debate is ongoing. As a consumer, what can you do? Be aware of your rights: if you suspect you’re being unfairly penalized due to credit, you can file a complaint with your state insurance department. You can also choose insurers that put less emphasis on credit (we mentioned a couple earlier). And of course, improving your credit is a tangible way to protect yourself from higher rates.

At Cogo Insurance, we advocate for transparency and fairness. We keep an eye on these legal developments so we can inform our clients. Most importantly, we treat each client’s situation individually – if your insurance score isn’t great, we don’t judge; instead, we work harder to find an insurer that offers a good rate for you, and we provide tips (as given above) to help you improve that score over time. Cogo Insurance can help clients with any insurance or credit score, and we’ll continue to do so regardless of how the laws or lawsuits evolve.

Conclusion

Your insurance score can significantly influence the premiums you pay for auto, homeowners, and other personal insurance policies. It’s essentially a credit-based predictor of risk, and while it may not be intuitive, it has become a core part of insurance pricing in most states. We’ve covered that insurance scores usually range from around 200 up to 997 points, with scores above ~775 being considered excellent. These scores correlate strongly with your regular FICO credit score – good credit usually means a good insurance score, which in turn means better insurance rates. We’ve also highlighted that nearly all major insurers use insurance scores (except in states that ban it), and we listed many of those insurers and states for clarity.

Crucially, it is possible to improve your insurance score. By focusing on proven credit-improvement steps like paying on time, reducing debt, and avoiding excessive new credit, you will see your scores rise and your insurance costs potentially drop. It’s equally important to know that even if your score is low today, you’re not doomed to exorbitant insurance forever. Consumers have options: some insurers weigh credit less, some states offer protections, and independent agencies like Cogo Insurance can help find competitive quotes for any credit situation.

In summary, an insurance score is one factor you can take control of over time. It rewards financial responsibility, and improving it can save you money not just on loans but on insurance as well. Remember that Cogo Insurance is here to help – whether you have excellent credit or are rebuilding it, we’ll assist you in securing the coverage you need at a great value. Contact Cogo Insurance to discuss your insurance needs, and let us use our expertise to help you navigate the world of insurance scores and premiums. We work with clients across the credit spectrum and believe that everyone deserves quality insurance at an affordable price.

FAQ

Q: What is a good insurance score?

A: A “good” insurance score generally means a score high enough to qualify you for the best insurance rates. This varies by scoring model and insurer, but using the LexisNexis Attract scale as an example, a good insurance score is roughly 776 or above (on a 200–997 scale). In that model, 776+ is the top tier, indicating you have excellent credit habits. Many insurers consider scores in the 700s as good. For TransUnion’s insurance score, around 770 or higher is deemed a good score. Essentially, if your insurance score falls in the top range (whether that’s top 20% or so of consumers), insurers will usually offer you their most favorable rates. Keep in mind each insurer sets its own thresholds, so one might consider 750 “excellent” while another is okay with 700+. The key is that higher is better – if your insurance score is in the good/excellent range, you should be getting credit-based discounts on your premiums.

Q: Is an insurance score the same as a credit score?

A: No – an insurance score is based on your credit information, but it’s not identical to your FICO or Vantage credit score. An insurance score (credit-based insurance score) uses data from your credit report to predict insurance risk (likelihood of filing claims), whereas a traditional credit score predicts likelihood of credit default (like missing loan payments). They consider similar factors (payment history, debt levels, credit length, inquiries, etc.), but weighted differently for the different purposes. Also, they often operate on different numeric scales. For example, most credit scores range 300–850, while some insurance scores range 200–997 or 0–1000. You typically can’t look at your 750 credit score and know your insurance score, but there’s a correlation – if that 750 was achieved by good financial behavior, your insurance score will likely reflect that. Think of it this way: your insurance score is like a cousin of your credit score; related and influenced by the same upbringing (your credit habits), but ultimately a separate measure designed for insurance use.

Q: Do all insurance companies use credit scores for pricing?

A: Most do, but not all. It’s reported that about 95% of auto insurance companies (and the majority of home insurers) use credit-based insurance scores when allowed by state law. All the big-name insurers (State Farm, GEICO, Progressive, Allstate, etc.) use credit as a factor in the states where it’s permitted. However, a few insurers choose not to use credit, either due to their business model or legal restrictions. For instance, in California, no insurer can use credit (it’s illegal there), so companies operating in CA don’t use it for those policies. Additionally, some newer insurers like Root Insurance have publicly announced plans to stop using credit scores by 2025. Another small company might offer “no credit check” insurance in certain markets (often at higher base rates though). By and large, if you’re shopping for insurance in the U.S., expect your credit will be considered in most cases. If you prefer an insurer that doesn’t use credit, you’ll have to seek out those few exceptions or be in a state that bans it. Cogo Insurance can help identify carriers that don’t use credit if that’s a concern, but keep in mind those options may be limited.

Q: Which states prohibit insurance companies from using credit scores?

A: As of 2025, the states with bans or heavy restrictions on credit-based insurance scoring are:

-

California: Bans use of credit for auto and homeowner insurance rates.

-

Hawaii: Bans credit use for auto insurance (but allows it for home insurance).

-

Massachusetts: Bans use of credit for auto and home insurance.

-

Michigan: Credit can’t affect auto/home insurance rates or eligibility (it’s only allowed for payment installment decisions).

-

Maryland: For auto insurance, insurers can use credit for new policies’ rate setting (with limitations) but not for renewals; for homeowners insurance, credit use is generally not allowed for rates.

A few other states have partial limits (e.g., Oregon restricts use to new policies, Utah allows credit to be used only to lower rates or for new policy underwriting, Nevada had a temporary ban through May 2024). Always check your state’s current regulations or ask your agent. These laws can change with new legislation. If you’re in a state with a ban, your credit score shouldn’t impact your insurance at all. If you’re elsewhere, assume credit is in play. Cogo Insurance stays updated on state rules – we’ll let you know if credit applies to your quote and how it’s influencing your rate.

Q: How can I check my insurance score?

A: There isn’t a simple “check my insurance score” tool like there is for checking your credit score, but you have a few indirect ways to get the information:

-

Ask Your Insurer or Agent: Some insurance companies will tell you the general result of your insurance score if you ask, especially if it adversely affected you. You may not get the exact number, but you can get an idea (“your score put you in Tier B out of A–E tiers”, for example). Cogo Insurance can help inquire with an underwriter if needed.

-

Adverse Action Notice: If you receive a notice that your policy’s rate or offer was worse due to credit, that notice will list reason codes (like “too many late payments” or “insufficient credit history”). While it might not show the score, it tells you what areas to check on your credit report. The notice also entitles you to a free copy of the credit report or insurance score report used. Follow the instructions on the notice to request it (often it will direct you to a website or phone number for the report, e.g., LexisNexis or a credit bureau).

-

LexisNexis Consumer Report: As mentioned earlier, you can order your LexisNexis consumer disclosure file for free once a year. This report will include insurance inquiry information and possibly your Attract insurance score or at least the factors affecting it. Visit the LexisNexis Risk Solutions portal or call their consumer center to request your report. It may take a couple weeks to receive by mail.

-

Credit Score as Proxy: Although it’s not the same, checking your own credit score (available through many banks or free services) can give you a rough idea. If your credit score is improving, your insurance score likely is too. Conversely, if you have poor credit, assume your insurance score is also poor. Many of the steps to check and improve one will benefit the other.

In short, while you might not see a neat “insurance score” on a dashboard, the information is accessible through disclosures and careful review of your credit reports. If you’re curious or concerned, definitely obtain your reports and talk to your agent. Cogo Insurance can assist in interpreting any cryptic reports or guiding you on what to do with the information.

Q: Will a low insurance score prevent me from getting insurance?

A: Generally no – you can still get insurance coverage even with a low insurance score, but you may pay more for it. Insurers cannot deny you a policy solely due to a low credit-based score in most states (and some states forbid using credit for approval decisions altogether). What usually happens is that a low insurance score places you in a higher-risk pricing tier. You might not qualify for the best advertised rates, but the insurer will still offer a policy at a higher premium. In extreme cases, a very low score combined with other risk factors (like multiple recent claims, etc.) could lead some standard-market insurers to decline coverage. If that happens, there are typically other insurers – including non-standard or high-risk carriers – that will insure you, albeit at a higher cost. For example, if your score is poor, Cogo Insurance can look at options like specialty insurers who cater to drivers with imperfect credit or other issues. We can also check if any insurer offers a “second chance” program (some insurers, for instance, will give a neutral score to people without credit history or with very low scores, especially if other factors like driving record are good). So, while a low insurance score is a disadvantage, it’s not a dead end. You might have to pay more initially, but as you improve your credit/insurance score over time, you can shop again and likely find a better rate. We have helped many clients with subpar credit secure insurance – sometimes through state-assigned risk plans for auto or through surplus lines carriers for homeowners if needed – and then helped them transition to standard carriers once their situation improved. The key is to never go uninsured; there’s always an option out there. And remember, insurance scores can change. Cogo Insurance can help you re-shop your policy at renewal to see if your improving score can save you money with a different carrier.

Q: How much can improving my credit score actually lower my insurance premium?

A: The savings can be quite significant. While it varies by insurer and state, numerous analyses have shown that drivers with poor credit pay anywhere from 20% to over 100% more for insurance than those with excellent credit. For instance, one study found that nationally, drivers with “poor” credit paid about 61% higher auto insurance rates on average than drivers with “good” credit. In dollar terms, this could be an extra $1,000 or more per year for full coverage auto insurance. By moving from a poor credit tier to a good credit tier, you could save hundreds of dollars annually. Even moving from fair/average to good can yield double-digit percentage discounts. On homeowners insurance, the differences can also be noticeable (though often a bit less dramatic than auto). The exact impact also depends on how credit is filed in the rating algorithm – some insurers give a modest 5-10% discount for excellent credit, others have a wider spread. The bottom line: improving your score is very likely to reduce your premiums, and it could be one of the bigger cost factors. We at Cogo Insurance have seen clients go from, say, a mid-600s score to 700s and suddenly qualify for a preferred tier that saved them 20% on their renewal. Your mileage may vary, but it’s one of those personal finance “two-fers”: better credit saves you interest on loans and lowers your insurance costs. If you want an estimate of impact, ask your Cogo agent – we can often simulate a quote with different credit tiers to show the potential savings when your score improves.